Meet ScienceSoft’s Experts — the People Who Will Drive Your Project to Success

This page is devoted to the main driving force behind ScienceSoft — our people — and shows how we compose cross-functional teams that deliver consistent results, no matter the challenges.

Organized Around Outcomes, Not Departments

In most large financial IT companies, projects span 6–7 departments — front end, back end, mobile, UX design, QA, DevOps, security — each with its own leadership, agenda, and priorities. That means more handoffs, more red tape, slower decisions, and blurry accountability. Leaving this rigid model in the past, ScienceSoft is structured into four tightly connected units that are organized around outcomes, not tech silos.

Project Management Office (PMO)

This unit develops, empowers, and continuously trains project managers — specifically for financial IT initiatives. The PMO establishes the frameworks, methodologies, and mentorship programs that ensure every PM at ScienceSoft operates with precision and ownership. Our 60+ certified project managers are trained to prioritize your business goals, anticipate operational risks, and lead their projects to success despite emerging changes and constraints.

You get a single, responsible PM who owns the outcomes, not just team activities.

Architecture and Solutions Center of Excellence

This unit safeguards your project’s long-term success by minimizing technical risks and ensuring that every financial IT solution is secure, scalable, cost-effective, and accurate by design. Ten principal architects, each with over 15 years of hands-on experience in designing high-impact financial systems, lead the way. They continuously evaluate new technologies and improve our architectural practice, acting as consultants for critical project decisions.

Your project is shaped by strategic thinking, not just code execution.

Technology and Competency Center of Excellence

This unit ensures that our people outperform the market. It is a team of 50+ senior experts in financial technologies, niche IT services (e.g., infrastructure, cybersecurity), and key BFSI domains, such as banking, investment, insurance, lending, payments, and DeFi. They run training programs, create personalized growth plans, and coach our talents. Their mission is to ensure that every person we assign to your project is fully prepared — technically, strategically, and contextually.

From day one, you get a team of high-performing professionals — familiar with your domain, sharpened by continuous learning, and focused on delivering measurable results.

Competency Pool

Among our 600+ IT specialists are software and QA engineers, data scientists, DevOps, security, and compliance experts, business analysts, UX/UI designers, and other professionals who are continuously maintained and trained by the Technology and Competency CoE. Over 50% of all our tech talents are senior and lead-level specialists. From this pool, project managers and solution architects assemble cross-functional teams centered around each financial IT project’s unique needs and goals.

You don’t have to worry about whether we have the right talent on board. We always do — ready, trained, and immediately deployable.

A pool of 600+ IT specialists — mobilized by project

Financial IT consulting and business analysis

Domain-focused experts who shape the vision of BFSI solutions — banking, investment, insurance, lending, payment, fintech, DeFi — structure requirements, and plan financial software for accuracy, longevity, and compliant operations, grounding every project in real-world business value.

Financial software engineering

Developers, platform engineers, and integration specialists who bring together deep technical expertise across modern and legacy stacks — from .NET and Java to big data, blockchain, and financial IoT — and form the reliable core of our financial software delivery teams.

AI and data science for finance

AI engineers, GenAI consultants, and MLOps experts who turn the BFSI organization's complex goals into intelligent solutions and ensure each AI-powered solution is designed for transparency and compliance, fine-tuned for accuracy and performance, and optimized for costs.

Data management and analytics

Data experts, from data processing pipeline engineers to business intelligence (BI) analysts, who make sure that the right data for finance automation is always available, structured, secure, and actionable.

Cybersecurity and compliance management

Ethical hackers, compliance consultants, and security engineers who create a robust defense layer across financial solutions, embedding security into architecture and operations from day one and helping clients stay protected and compliant.

Quality assurance and testing

QA consultants and engineers, including manual and automation testers covering functional, performance, security, and accessibility testing, who help us deliver accurate, stable, and user-ready financial software.

Financial IT infrastructure management and DevOps

From cloud architects to SREs and DevOps engineers, these people ensure that our financial IT solutions are not only well-built but also easy to deploy, scale, and maintain — keeping performance high and costs in check.

Support and help desk

Multilingual professionals who combine technical skills with a proactive mindset. From resolving user issues to optimizing financial IT systems and processes, they’re the people who keep digital BFSI operations running smoothly.

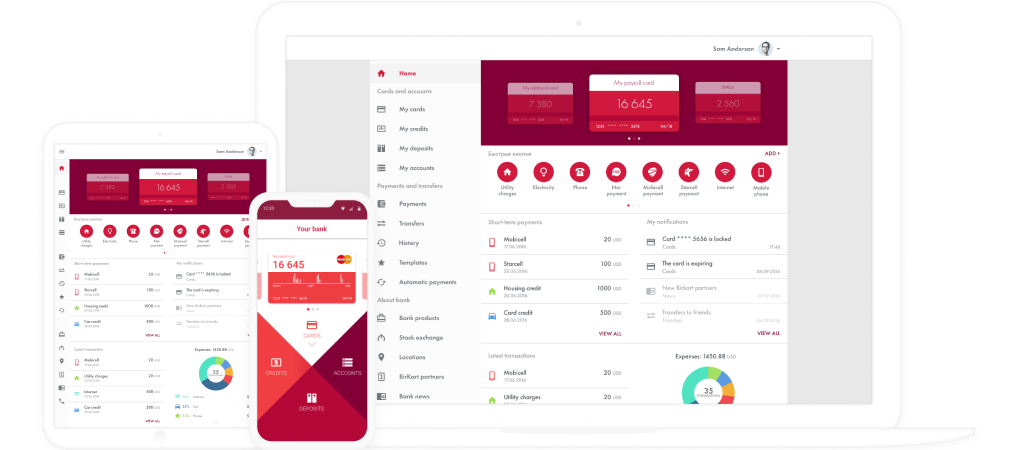

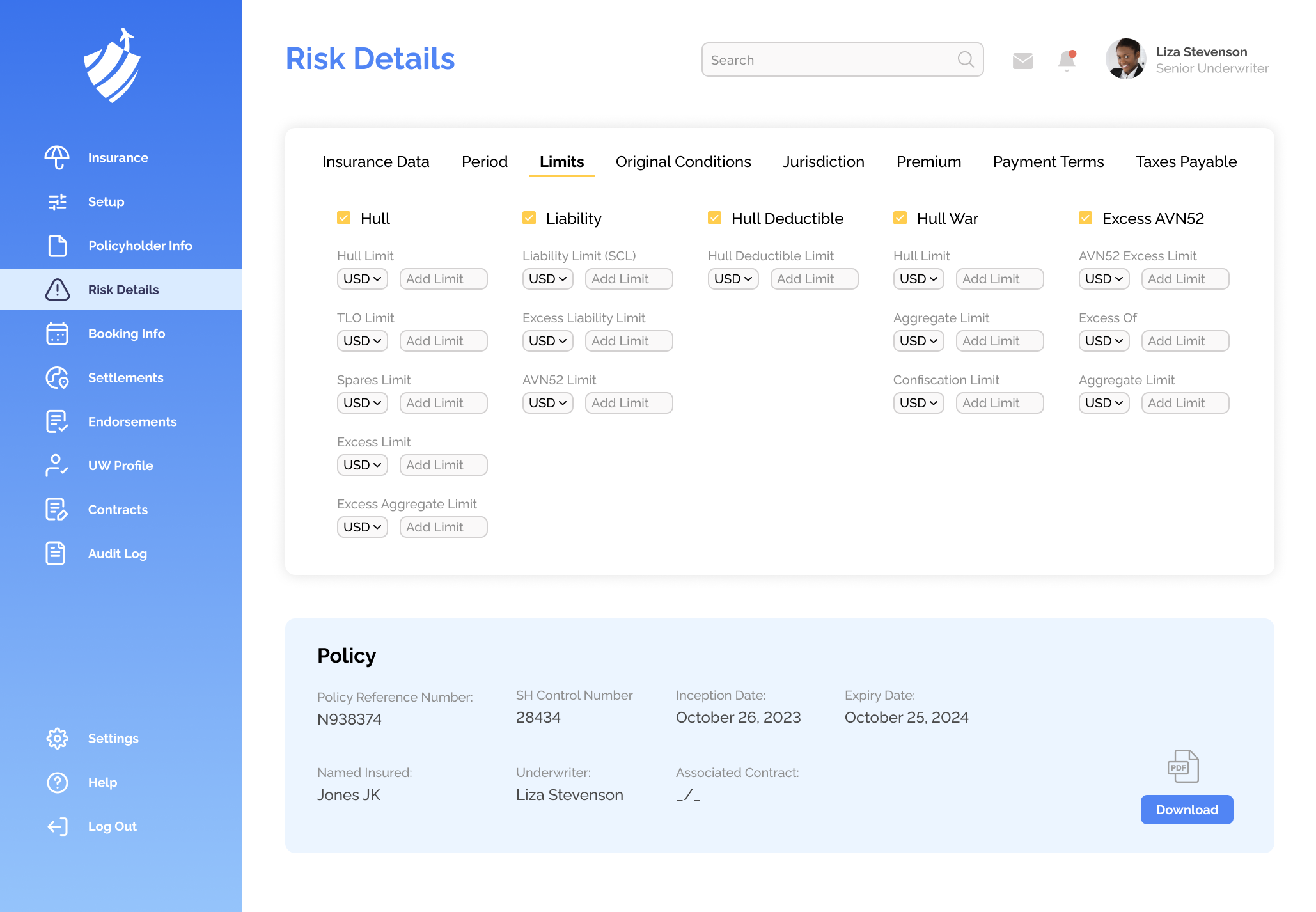

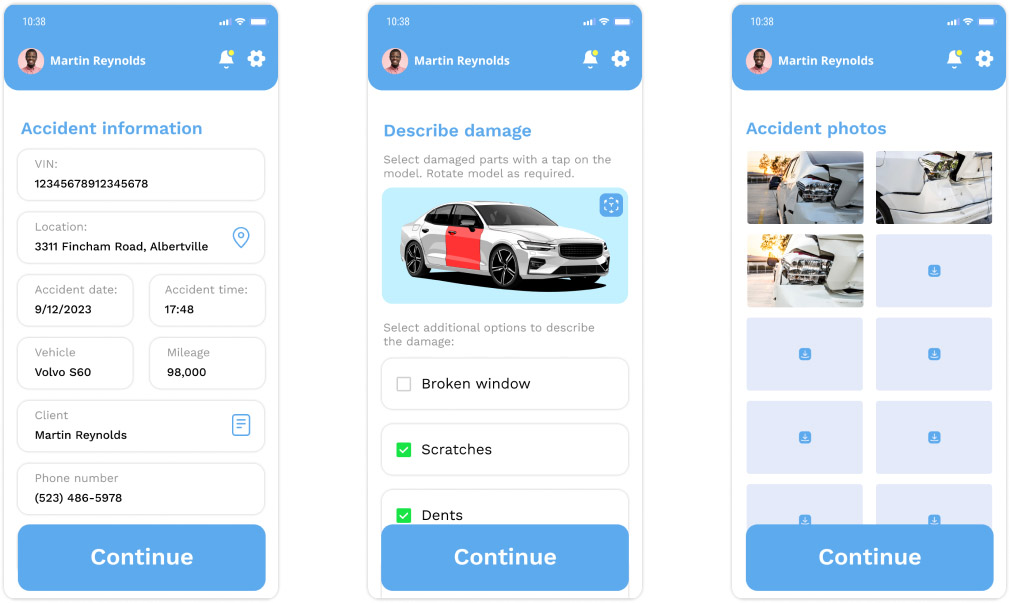

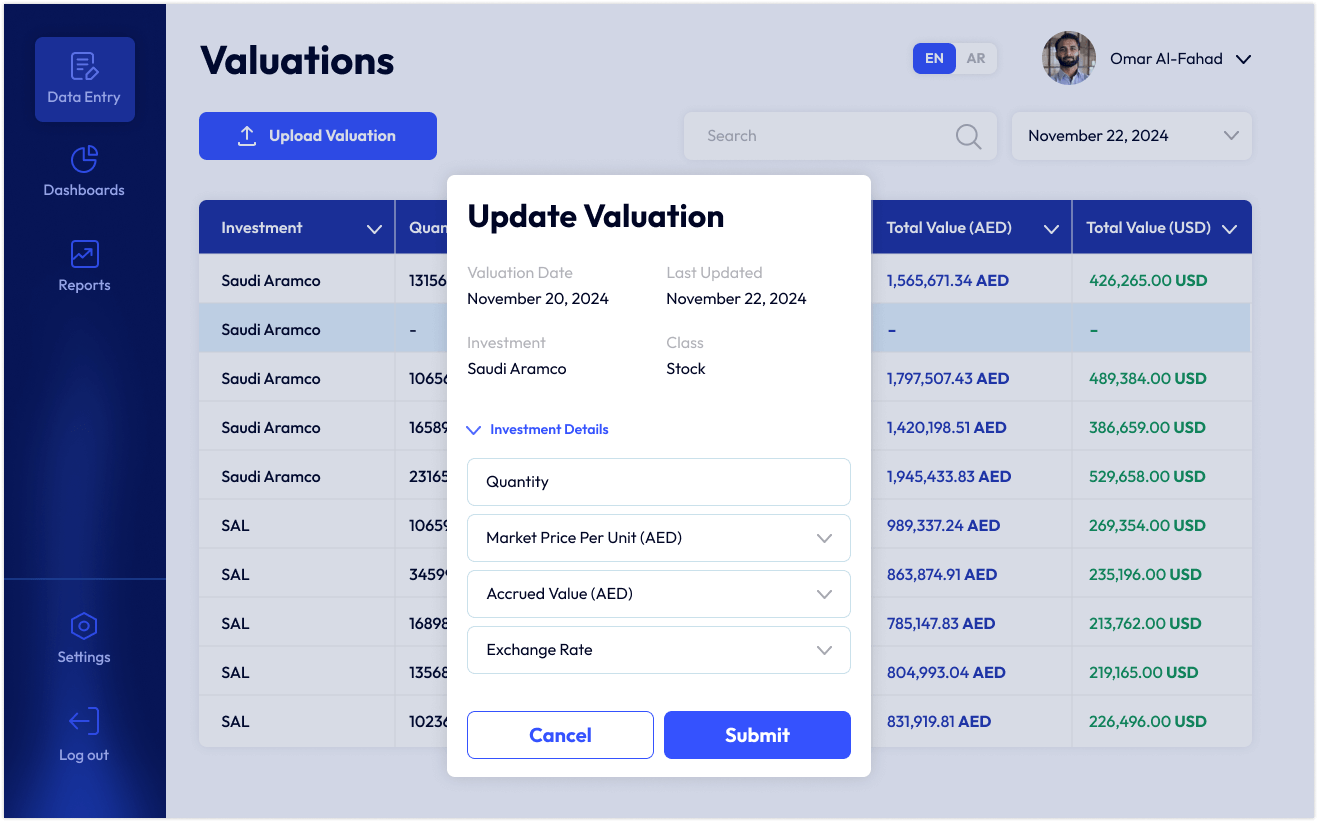

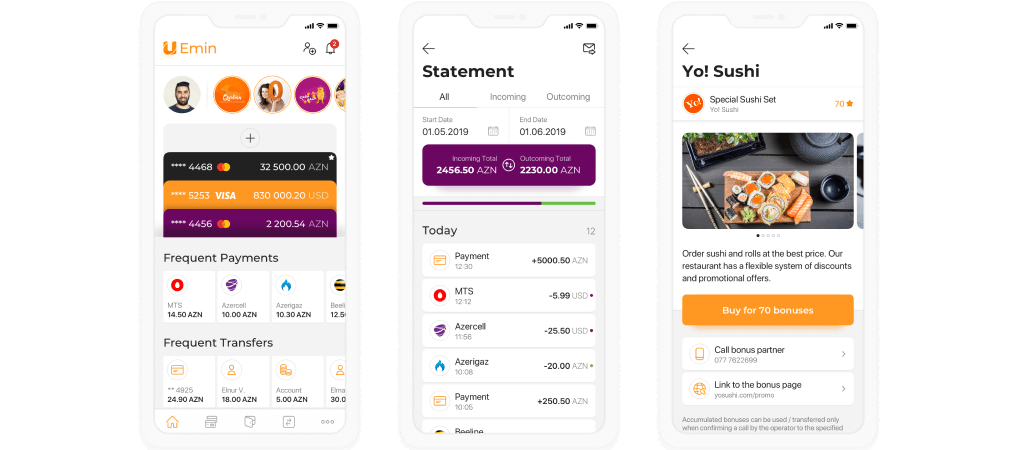

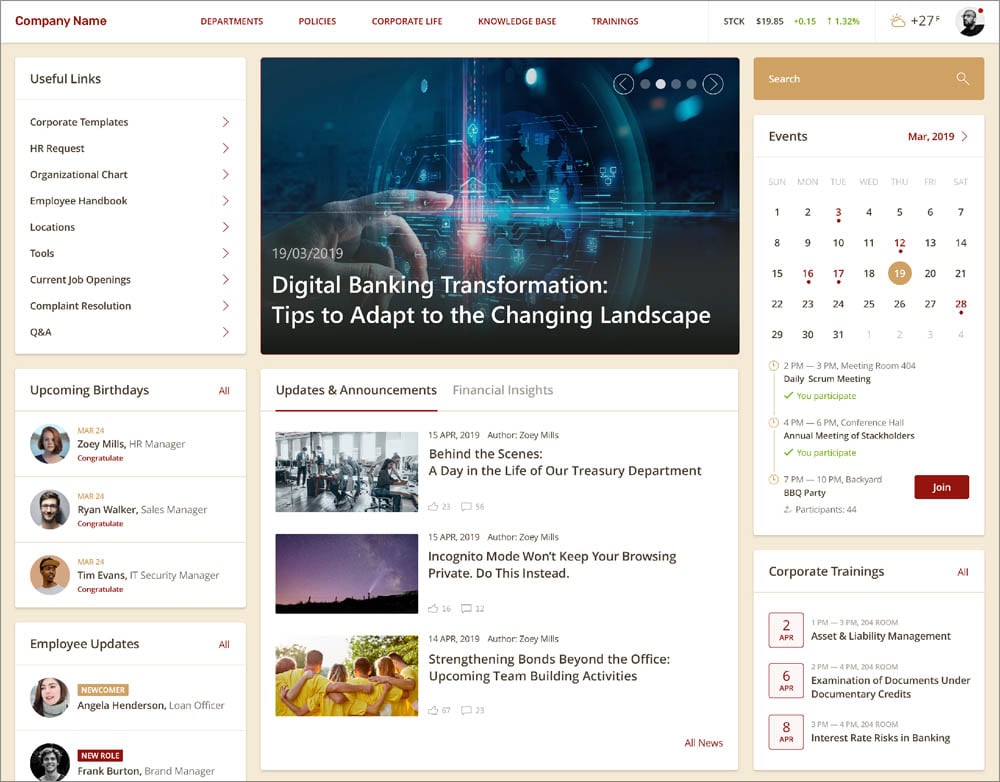

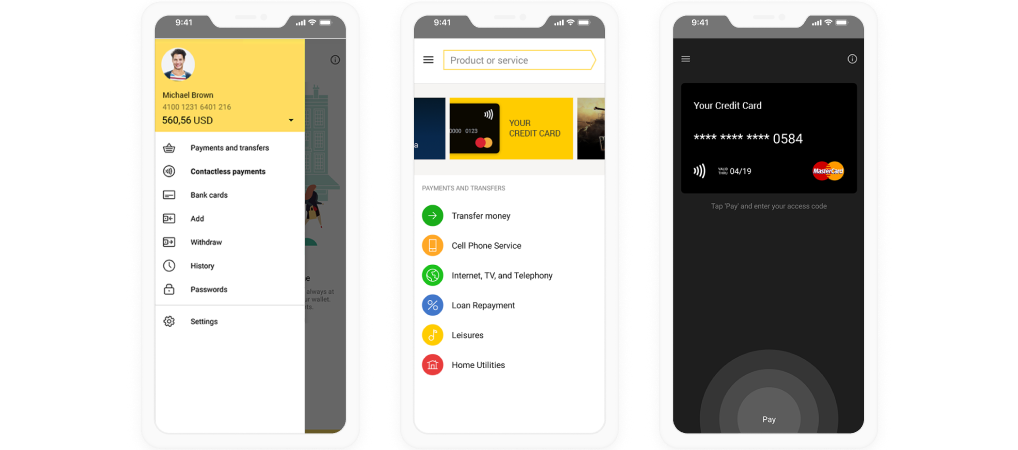

UX/UI design

UX and UI designers who create human-centered, frictionless, visually balanced design of financial applications and ensure rich data visualization and user convenience in complex financial automation and analytics systems.

Project Management Office (PMO): Planning and Acting

We don't just oversee finance IT projects; we drive them. My team clears the path to success by paving the fastest and smoothest route to the project’s goals — despite evolving customer expectations, shifting regulations, and the challenges of legacy systems.

-

60+ full-time project managers (PMs) with industry-recognized certifications, such as PMP, PSM, PMI-ACP, PMI-PMOCP, CSM, PSPO, ITIL 4, CSPO, and ICP-APM.

- We employ project managers with expertise in BFSI domains (e.g., banking, investment, insurance) and service directions (e.g., legacy financial software modernization, testing, IT support). They see what others miss: hidden risks, cost- and time-saving opportunities, and smarter paths forward.

- Our PMs do far more than just team coordination. They take full ownership of your project’s success and handle the arising challenges, be it tight deadlines, constrained budgets, rapidly evolving scope, or competing priorities. PMs’ responsibilities include project planning and estimation, management of change requests, risks, timelines, and budget, aligning multiple stakeholders, managing distributed teams, and ensuring smooth and transparent collaboration.

- We don’t leave PM performance to chance — it’s rigorously measured, audited, and enhanced. Externally, we track all key project health indicators, analyze formal and informal client feedback (including NPS and retention), and monitor project outcome quality. Internally, we audit how well our established best practices are followed during real project delivery and track how our PMs grow — earning new certifications, mentoring others, and stepping up to more complex leadership roles.

- 60% of client reviews on software engineering projects from 2019–2025 specifically highlighted project management excellence at ScienceSoft.

Architecture and Solutions Center of Excellence: Innovating and Creating

The versatility of technology and financial orgs' needs has taught us to approach each project as a unique case and seek architectural and engineering solutions that best fit its specific context.

-

A team of 30+ solution and technology architects. We’re proud to say that the architect density — the ratio of architects to overall technical staff — at ScienceSoft is 2–3x higher than the industry average. This ensures that every financial software project gets a dedicated architect, as well as fosters the exchange of ideas and continuous innovation.

- Our architects hold top certifications in the field, from AWS Solutions Architect and Azure Solutions Architect to TOGAF and IASA CITA.

- Ten principal architects, each with over 15 years of hands-on experience in building global-scale financial IT systems and innovative financial solutions, are the backbone of the Architecture and Solutions CoE. Their mission goes beyond architecture design for individual projects:

- They set the architectural vision and strategy across ScienceSoft.

- They mentor and train senior and middle architects, nurturing deep technical expertise and business-oriented thinking.

- They lead the adoption of modern technologies and architecture paradigms, helping our teams embrace innovation in a way that fits real-world needs and doesn’t introduce unnecessary risks.

- They ensure architecture stays a driver of business outcomes — not just a layer of documentation.

Technology and Competency Center of Excellence: Elevating and Empowering

Tech skills alone don’t win projects that demand sustained complexity, consistent delivery, and close collaboration over years to achieve measurable financial service transformations. Alignment, accountability, and attitude do — and we train our teams for all three.

-

A team of 50+ niche experts in specific service areas (e.g., engineering, QA, cybersecurity), BFSI fields (portfolio valuation, underwriting, credit scoring, etc.), sectoral regulations (e.g., SEC for investment, NAIC for insurance), and value-driving financial techs (AI/ML, big data, blockchain).

- They lead all technical hiring at ScienceSoft, conducting rigorous interviews and assessments to recruit and retain top talent.

- They foster a mentorship culture by pairing senior members with new hires to accelerate knowledge transfer and skill development.

- They create personalized development plans for every team member and manage training, workshops, certifications, and conferences.

- They work closely with resource managers to assemble well-matched project teams that are aligned with client needs.

- They conduct formal performance evaluations for all our team members, offering in-depth feedback on accomplishments, goal progress, and opportunities for growth.

Competency Pool: Assembling and Delivering

Our job is to make sure you never worry about the ‘who.’ You bring the vision, we bring the team to realize it. The seniority of our people is best reflected in the quality of financial solutions we deliver — and our standards are nothing short of exceptional.

We hire only the top 2% of applicants and maintain a senior-heavy talent pool — over 50% of our 600+ tech experts are seniors and leads. But it’s our internal structure and training that turn this talent into reliable teams that drive consistent results. With continuous mentoring, coaching, strong collaboration, and a unified delivery culture, our professionals work as a cohesive unit, no matter which technology or industry vertical they belong to. This enables us to quickly assemble cross-functional teams that work in sync from day one — fully aligned with your goals, timelines, and domain specifics.

Our experts are available for direct press inquiries

|

|

Head of Technology and Competency Development, Financial IT Principal Consultant |

|

Financial and Banking IT Consultant and Lead Business Analyst |

|

|

Insurance IT Consultant and Lead Business Analyst |

|

Insurance IT Consultant and Lead Business Analyst |

|

|

Lending IT Consultant and Senior Business Analyst |

|

Investment IT Consultant and Senior Business Analyst |

|

|

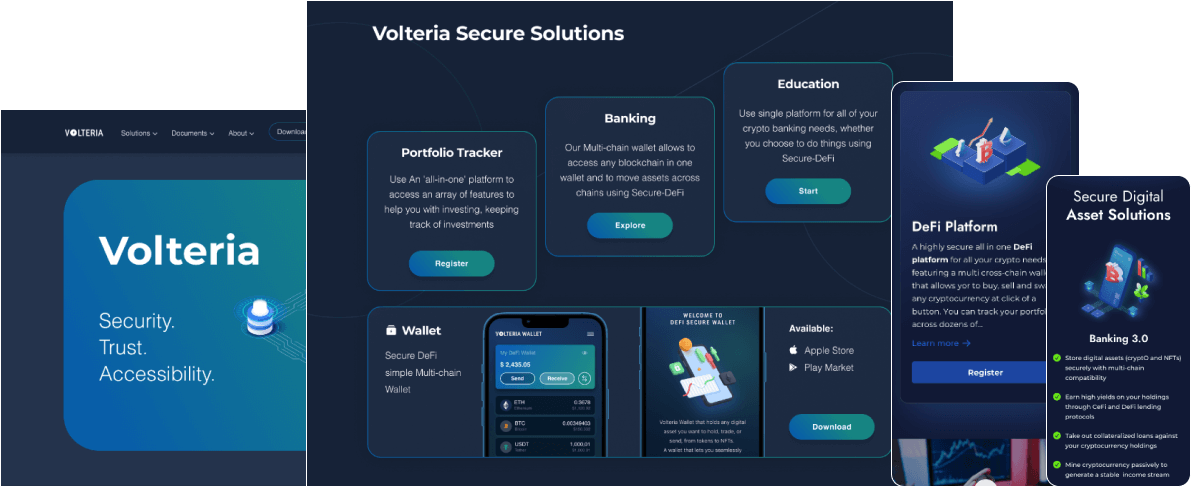

DeFi & Blockchain Consultant and Senior Business Analyst |

|

Financial Technology and Blockchain Researcher |

AI and data science for finance

- AI and machine learning (ML) engineers with expertise in GenAI, natural language processing, computer vision, recommendation engines, and anomaly detection systems for the financial service domain, including niche areas like insurance underwriting, wealth advisory, and credit debt collection.

- AI consultants who advise our clients on how to translate business goals into efficient, high-ROI AI solutions. They draft AI technology roadmaps in alignment with the organization's risk management practices, data security standards, and relevant regulatory frameworks. They also guide the adoption of AI solutions with a strong focus on model accuracy, explainability, fairness, and ethical use — making sure financial AI is deployed responsibly and sustainably.

- Prompt engineers and architects who integrate pretrained LLMs (e.g., GPT, LLaMA, Claude, Gemini) into custom software and domain-specific workflows (for investment, insurance, lending, etc.).

- Machine learning and deep learning model designers and trainers who tune model performance, accuracy, and generalization.

- MLOps and cloud ML specialists who set up and optimize model lifecycle automation, deployment orchestration, scaling, versioning, and cross-environment reproducibility.

- TCO analysts dedicated to optimizing infrastructure and financial AI workload expenses across both cloud and on-premises deployments.

Data management and analytics

- Data architects who design scalable and secure financial data storage solutions — data lakes, warehouses, and lakehouses — on Snowflake, Azure Databricks, Amazon Redshift, Google BigQuery, Azure Synapse, and beyond.

- Data processing engineers who design and build high-performance batch or real-time data pipelines using tools like Hadoop, Apache Spark, Kafka, Flink, Airflow, and their cloud-native equivalents like AWS Glue, AWS Kinesis, Azure Databricks, Azure Stream Analytics, and Google Dataflow.

- Database administrators who handle performance tuning, data replication, high availability configurations, and backup and recovery processes across SQL (PostgreSQL, MySQL, MS SQL Server, Oracle) and NoSQL (MongoDB, Cassandra, DynamoDB) ecosystems.

- ETL/ELT specialists who build resilient pipelines for extracting financial data from diverse systems, transforming it into structured formats, and loading it into centralized storage for efficient search and analytics.

- Data governance experts who establish policies, lineage tracking, cataloging, and security controls in compliance with internal and globally recognized rules and standards such as SEC, GDPR, SOC 2, and ISO 27001.

- Metadata management and master data management professionals enabling organization-wide data consistency, discoverability, and quality across business directions (e.g., customer, product, service operations, finance, risk management) and technical domains (e.g., servers, applications, data sources).

- Business intelligence (BI) developers and analysts delivering intuitive and high-performing dashboards using Power BI, Tableau, Looker, and other leading BI tools.

Cybersecurity and compliance management

- Certified Ethical Hackers and security testers who conduct regular penetration testing and vulnerability assessments to detect and eliminate exploitable weaknesses in BFSI software solutions.

- Security architects, consultants, and engineers who identify and prioritize potential risks to sensitive data and compliance. They design organization-wide security programs and governance frameworks, embed security-by-design principles into IT architecture, and ensure adherence to globally recognized standards, including NIST CSF, OWASP ASVS, CIS Benchmarks, and ISO 27001.

- SIEM, SOAR, and XDR specialists who build and fine-tune centralized threat detection and automated response systems to provide continuous threat visibility and enable rapid incident resolution.

- Incident response specialists who are ready to contain a financial IT security incident, investigate its scope, and work with your organization to remediate the issue and prevent future security events.

- Cloud security experts for AWS, Azure, and GCP, ensuring robust protection across multi-cloud and hybrid financial IT environments.

- DevSecOps engineers who enable automated security checks and controls throughout CI/CD pipelines.

- Compliance consultants well-versed in PCI DSS/PCI SSF, NYDFS, SEC, GLBA, SOC 1/2, GDPR, and other key standards and regulatory frameworks.

Financial IT infrastructure management and DevOps

- A total of 65+ IT infrastructure engineers experienced in legacy system migration, hybrid cloud environments, IaaS/PaaS/SaaS architecture, financial IT network design, and planning for high availability and disaster recovery.

- Cloud cost optimization engineers who help reduce cloud spend in AWS, Azure, and Google Cloud by up to 40% through smart resource allocation and usage patterns.

- Site reliability engineers (SREs) focused on ensuring operational excellence and resilience of complex, large-scale financial IT systems.

- DevOps engineers skilled in designing, implementing, and optimizing CI/CD pipelines, container orchestration (e.g., based on Kubernetes, ECS), and observability stacks to accelerate and stabilize financial software delivery.

Support and help desk

- Multilingual L1 help desk specialists (English, Arabic, Spanish, German, French, Turkish, Polish, and more) who don’t just resolve tickets — they drive help desk improvement. Our support teams are trained to spot issue patterns, analyze root causes, and understand the business context to proactively reduce and prevent issues independently. The majority of our L1 agents are also technical people with a background in IT, so they can confidently solve basic technical issues without escalating unnecessarily.

- L2 and L3 support engineers who think long-term — they optimize IT costs, identify beneficial scaling opportunities, improve performance, assess automation potential, and proactively adapt the architecture to match your changing business needs.

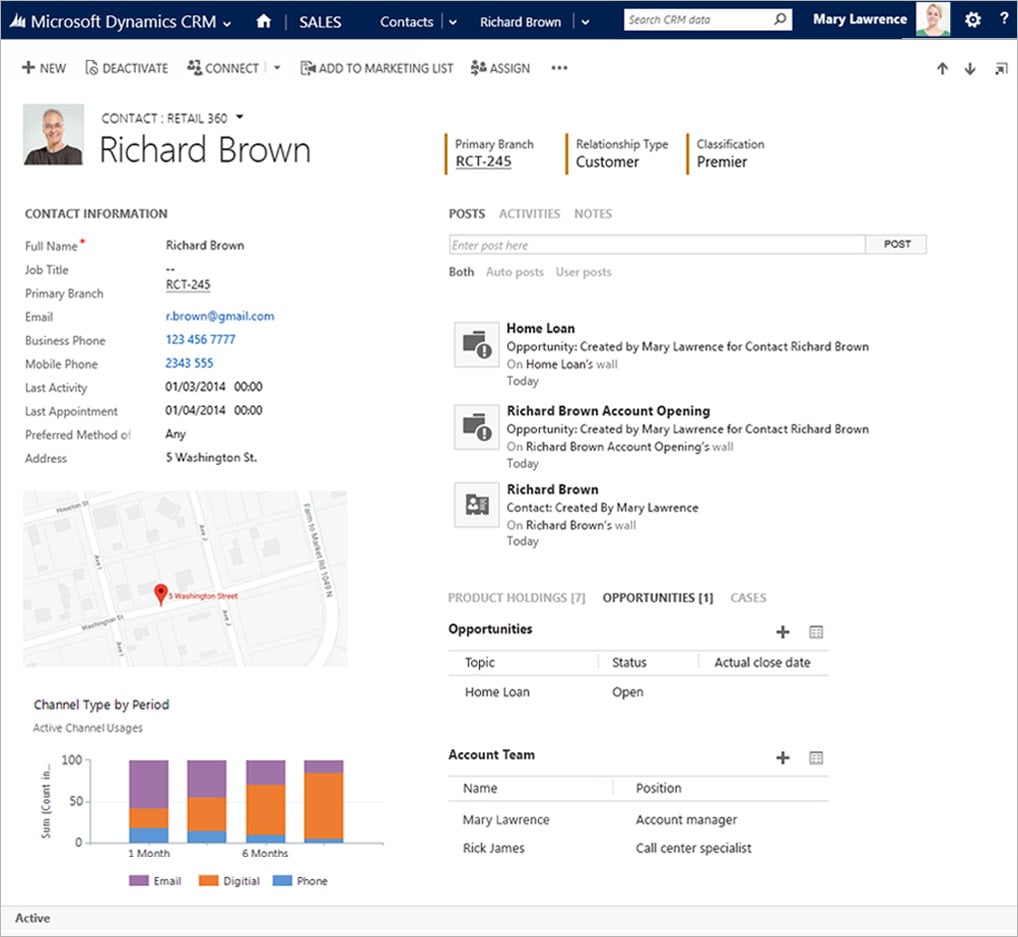

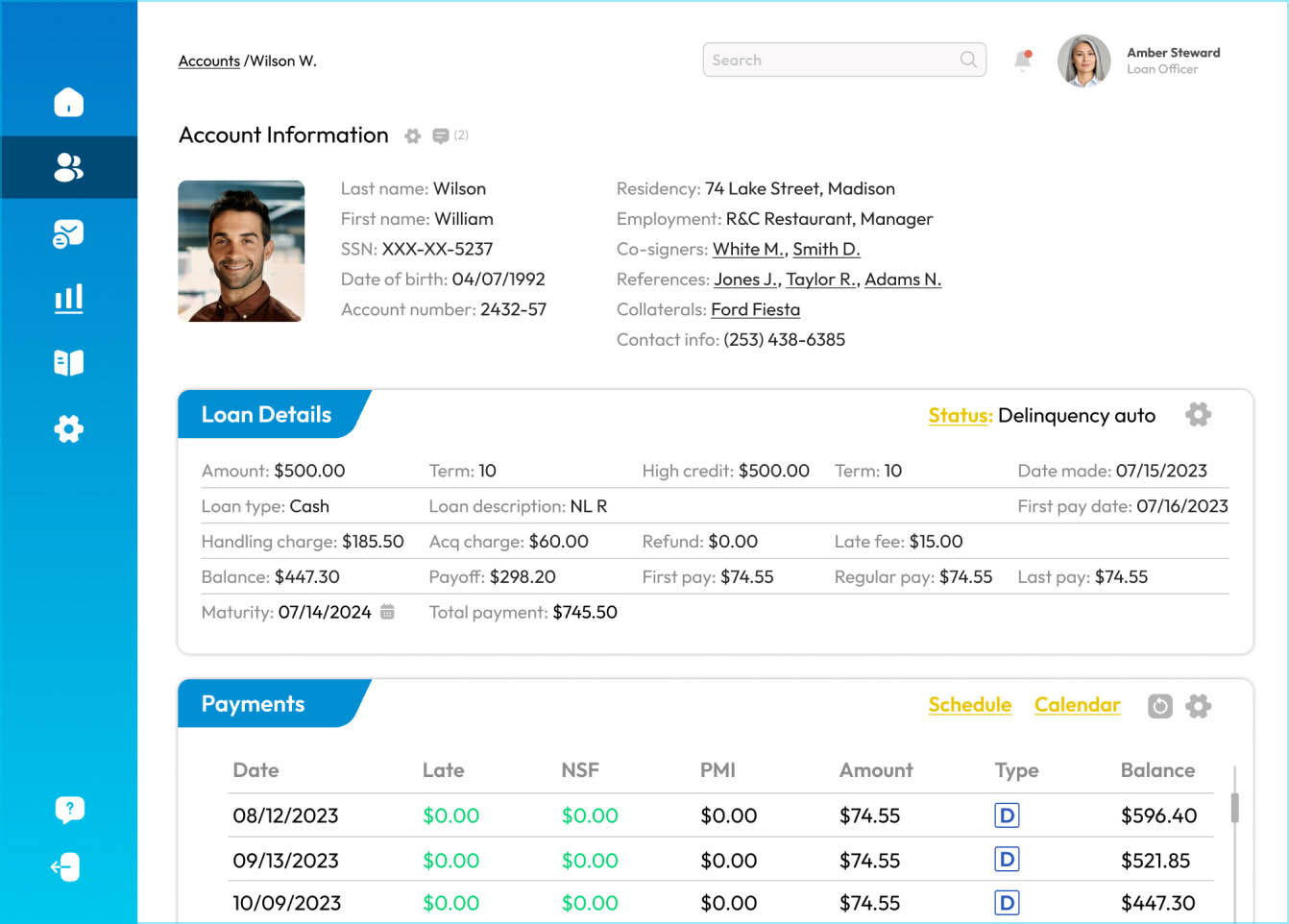

- ITSM experts experienced in top ITSM platforms like ServiceNow, Jira Service Management, Microsoft Dynamics 365, Salesforce Service Cloud, and more.

- Support team leads who work closely with client-side stakeholders to understand user pain points, suggest tailored improvements, and align support KPIs with business priorities. Their leadership ensures measurable outcomes: across long-term engagements, our teams consistently achieve first response time (FRT) of ≤30 min for emails and ≤40 sec for calls and user satisfaction (USAT) ≥90%.

UX/UI design

A Big Picture of ScienceSoft's Expertise

- Since 1989 in IT consulting and software development.

- Since 2005 in delivering IT services and solutions for BFSI.

- Full-scale PMO to manage complex and large-scale financial software projects.

- Experience with PCI DSS, SEC, GLBA, AML/CFT, NYDFS, GDPR, and other BFSI standards and regulations.

- Quality-first approach and robust security management backed by ISO 9001 and ISO 27001 certifications.

- Focus on long-lasting collaboration – 62% of our revenue comes from the customers we serve for more than 2 years.