Health Insurance Portals

Features, Development Steps, Costs, ROI

ScienceSoft relies on 13 years of experience in insurance software development and 20 years in healthcare IT to create custom health insurance portals that guarantee smooth user experiences and HIPAA-compliant PHI exchange.

Custom Health Insurance Portals: Quick Summary

Health insurance portals are designed to offer health payers’ members, agents, and healthcare partners convenient digital self-service tools, process automation capabilities, and secure access to essential insurance information.

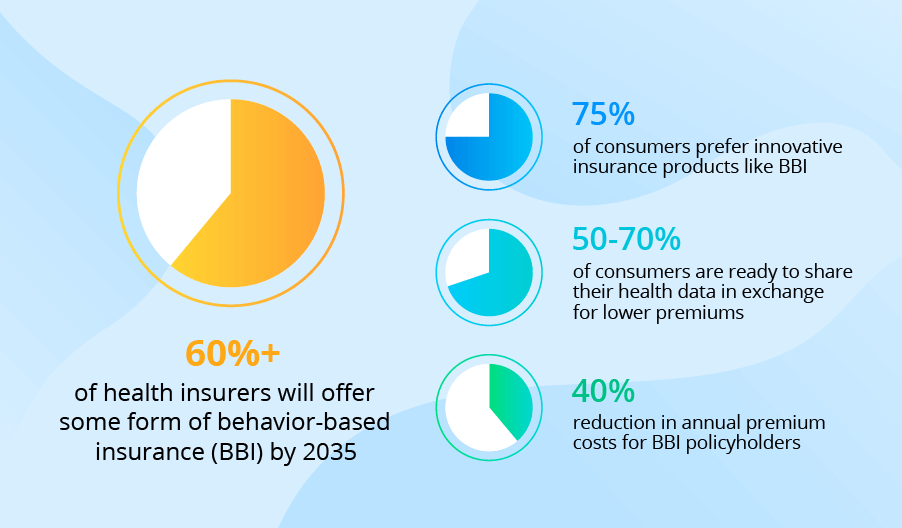

Custom health insurance portals are a popular choice among insurers who want to design the portal around their specific workflows or include advanced automation features powered by artificial intelligence (AI). Such solutions can be directly integrated with all required systems (including legacy software) of the health insurer, partnering healthcare providers, and other parties.

Another advantage of custom health insurance portals is that they can be designed to support operational compliance with HIPAA, CMS, NAIC, EHB, and other necessary global and region-specific regulations. Plus, custom portals have no UX and UI design restrictions, meaning you can introduce fully tailored user experiences.

Launching a custom portal lets health payers significantly improve employee productivity and drive higher member and partner satisfaction.

- Implementation time: 3–7 months.

- Development cost: $70,000–$450,000+, depending on the portal’s complexity and the chosen development approach. Use our free configurator to estimate the cost for your case.

- Average ROI: 190% within three years after launch.

Capabilities of Role-Specific Health Insurance Portals

In ScienceSoft’s projects, we create specialized and multi-purpose health insurance portals with functionality tailored to payers’ specific needs. Click on the cards below to explore the role-specific portal features often requested by our clients from the health insurance domain:

Key features for health insurance agents and brokers

Key features for portal administrators

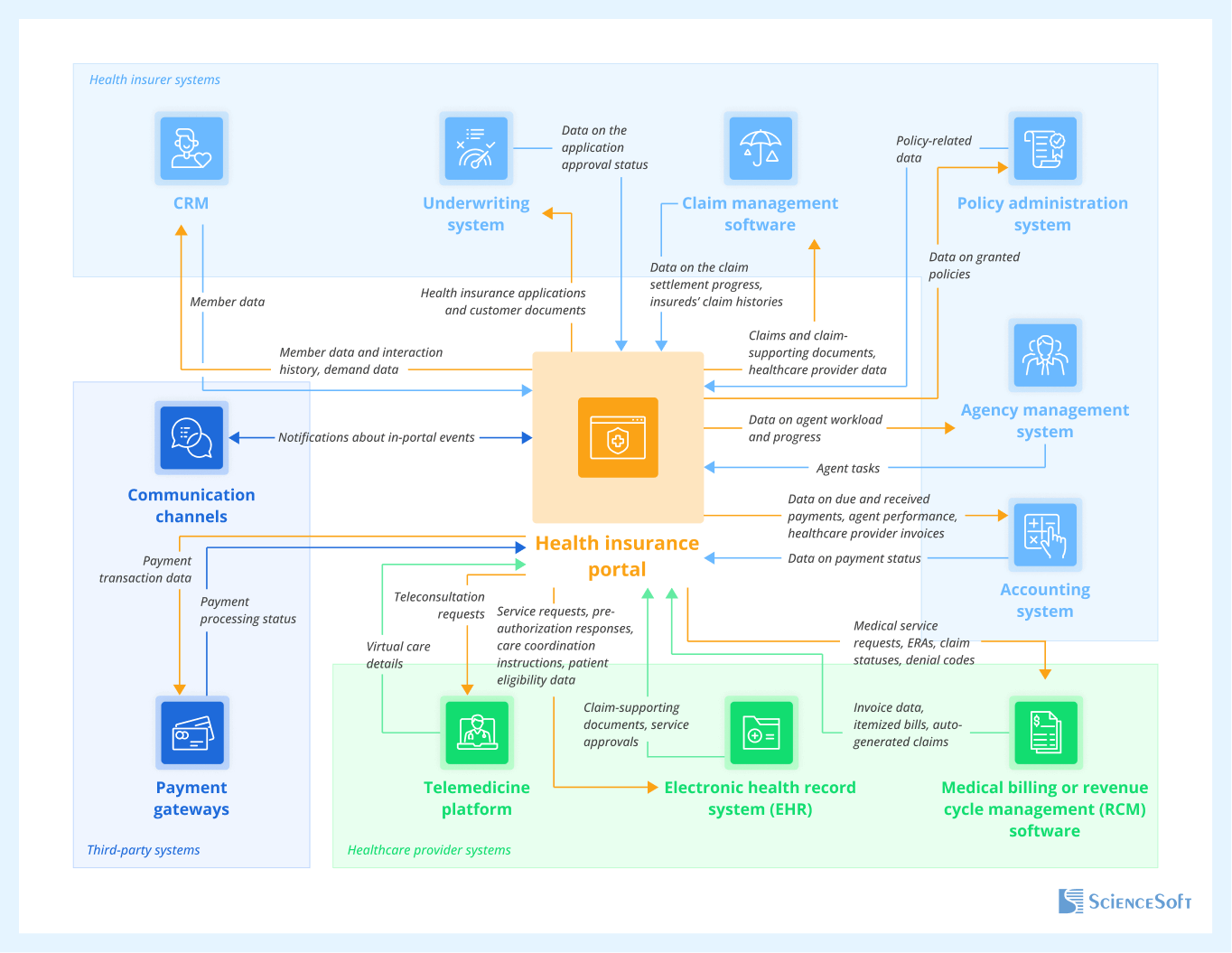

Important Integrations for a Health Insurance Portal

Integrating a health insurance portal with corporate and external systems helps enhance the degree of process automation and minimize low-value efforts.

Below, ScienceSoft shares a sample list of integrations for a health insurance portal. The actual list will depend on the user groups your portal serves and the specifics of your software system.

Health insurer systems

- For automated recording and centralized storage of all member data, including the history of interactions via the portal.

- For data-driven planning of marketing activities.

- To keep the insureds, agents, and brokers updated on the new health plans and personalized offerings.

- For faster processing of health insurance applications.

- To instantly communicate coverage-related decisions to insureds, agents, and brokers.

- For instant claim aggregation and facilitated claim status reporting to members.

- To provide agents and brokers with streamlined access to the members’ claim summaries.

- To streamline claim evidence gathering for data-driven claim settlement.

- To enable agents and brokers to promptly upload, access, and share policy-related data and documents.

An agency management system

For accurate planning of health insurance agent workload and streamlined agent task assignment.

- For automated recording of health insurance payment transactions in the general ledger.

- For streamlined agent payroll and broker commission management.

- For timely payments to healthcare providers.

Healthcare provider systems

Medical billing or revenue cycle management (RCM) software

- For quicker estimation of due amounts and invoice auto-population with patient and payer data.

- To speed up claim, invoice, and appeal submission to health payers.

- For accurate cash flow forecasting.

- For faster eligibility verification, service confirmation, and appointment scheduling.

- To promptly share claim-supporting documents with the payer.

- To enable swift access to remote medical services for members.

- For streamlined sharing of virtual visit summaries, health and treatment plans, and medication e-receipts with members and payers.

Third-party systems

- For instant processing of premium payments and real-time visibility into payment progress.

Communication channels

(SMS services, messaging apps)

- To quickly notify users about in-portal events.

7 Steps to Build a Secure and User-Friendly Health Insurance Portal

Below, ScienceSoft’s insurance software development team outlines the common steps and best practices for engineering secure and user-friendly health insurance portals.

1.

Requirements gathering and functional design

Insurance IT consultants analyze your needs and document functional requirements for the future portal. It’s important to map the necessary regulatory requirements at this early stage to guarantee compliant portal design from the onset. At ScienceSoft, we also advise our clients on the value-adding automation and self-service features (e.g., AI-supported document processing, smart assistants) that would increase the solution’s adoption and ROI in the long run.

2.

Technical design

Architects design a secure and scalable architecture for the health insurance portal and its integrations with the required systems, keeping in mind the need for easy portal evolution in the future. They also compose the optimal tech stack for portal engineering.

Rational tech stack choices can save insurers up to 70% in development costs. For example, if you don’t need portal integrations with legacy home-grown systems and don’t pursue never-before-seen UX/UI design, you could build your web portal on a low-code platform like Microsoft Power Apps or SharePoint. From my experience, this option usually costs around 3x less compared to developing from scratch.

3.

UX and UI design

UX/UI designers map out role-specific user journeys and create a modern, aesthetically appealing visual appearance of the health insurance portal. Opt for straightforward UX, laconic layouts, and neutral color palettes to avoid overwhelming users. Design teams at ScienceSoft stick to ISO 9241 guidelines for human-centered design to ensure that the portals we deliver provide intuitive workflows and clean interfaces.

4.

Project planning

Project managers determine the development project task scope, compose the optimal team, and define a tailored set of KPIs to control the team’s performance and project health. At this stage, ScienceSoft’s PMs are able to deliver time and budget estimates with up to 90% accuracy and introduce a pragmatic strategy to mitigate potential risks.

5.

Development and quality assurance

Development teams code the back end, create role-specific user interfaces based on the planned UI designs, and set up scalable data storage for your health insurance portal. Taking the Agile approach lets us deliver an MVP for the portal in 3–5 months and speed up further releases. At ScienceSoft, QA teams run tests (functional, usability, security) in parallel with development to quickly spot potential issues and prevent costly fixes at later project stages.

6.

Integration

The portal is integrated with your internal systems, the systems of your healthcare partners, external data platforms, and third-party services (payments, messaging, etc.). Integration testing is a must to validate data flow accuracy, interoperability, and security. At this stage, we also double-check adherence to HIPAA to ensure compliant PHI exchange among the connected systems and validate FHIR API interoperability with EHRs (USCDI-aligned). If compliance with the 21st Century Cures Act is applicable (where EHI exchange is involved), integration testing also involves HIPAA X12 837/835 transaction flows.

7.

Deployment

At this stage, engineers configure health insurance portal infrastructure, establish data backup and recovery mechanisms, implement robust network security tools (IDS/IDP, firewalls, SIEM, etc.), and set the portal live. In ScienceSoft’s engagements, we provide detailed technical documentation to streamline portal maintenance and draw user manuals to help members, agents, and healthcare providers quickly resolve arising issues.

Robust Techs and Tools for Health Insurance Portal Development

How Much It Costs to Develop a Health Insurance Portal

Building a health insurance portal may cost around $70,000–$450,000, depending on the portal's functional complexity, the number of user roles, the scope of integrations, and requirements for solution performance, scalability, security, and UX/UI.

Here are the ballpark cost estimates based on ScienceSoft's experience in similar projects:

$70,000–$150,000

A platform-based (e.g., SharePoint, Power Apps) agent portal providing basic workflow automation features and connected to 1–3 internal systems.

$100,000–$250,000

A custom member self-service portal of average complexity, integrated with 2–5 internal or partner systems.

$250,000–$450,000+

A comprehensive portal spanning several role-specific interfaces (e.g., for members and healthcare providers) and offering value-adding features like smart AI assistants and telehealth integration.

Key Benefits of Health Insurance Portals

A tailored health insurance portal can bring around 190% ROI within three years after launch.

The ROI is driven by the following major benefits:

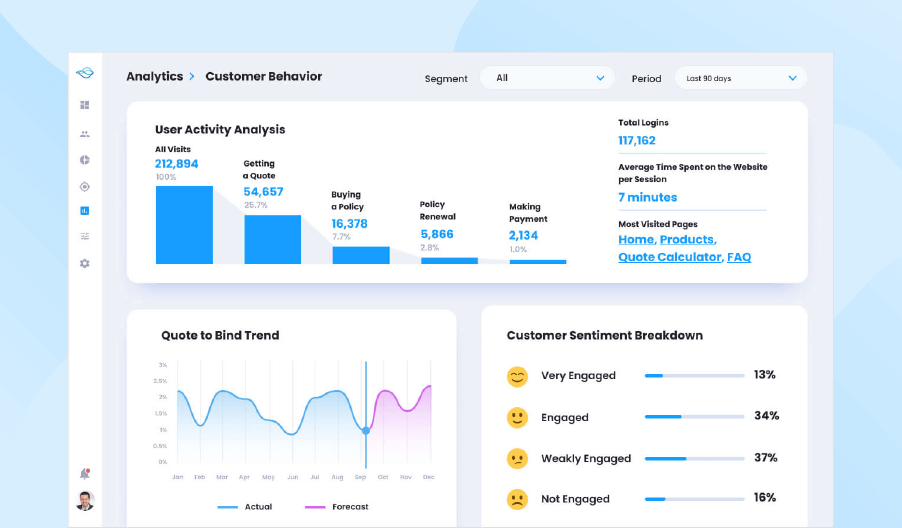

Enhanced customer experience

Equipping members with convenient digital self-service tools and providing personalized user journeys drives up to a 90% increase in customer engagement and an 80%+ improvement in retention.

Improved operational efficiency

Introducing self-service options lets health payers achieve a 50%+ reduction in agent workload. Agent-side task automation, digital collaboration, and instant data access features enable 2–25x quicker workflows.