Trading App Development Services

In financial software engineering since 2005, ScienceSoft creates secure trading apps that introduce smooth trader experiences and compliant trade processing. Our principal architects balance the scalability and latency of trading apps to optimize their TCO while guaranteeing competitive performance.

Trading app development services allow traditional investment service providers and fintech startups to release secure and compliant trading apps fast and at a fraction of the cost of in-house development.

Unlike white-label trading apps, custom solutions aren’t limited by a rigid functional scope and can be connected to any legacy and modern systems for direct data exchange. Brokers and wealth managers often go for custom trading apps to avoid integration issues, introduce support for alternative vehicles, and be able to accommodate region-specific compliance frameworks.

Who We Build Trading Apps For

Retail brokers and broker-dealers

We can upgrade your legacy trading solution or deliver a new custom app aligned with your target audience and execution flows. You get a modular cloud-native architecture, secure APIs, observability, and compliance controls that your team can map to obligations.

Neobrokers and fintech startups

You get an MVP of a trading app in 3–7 months, with a clear path to app expansion with value-adding features. The market-ready MVP will feature trader-centered UX, a stable architecture ready for peak loads, essential integrations (broker, data, KYC), and audit-ready logs.

Wealth managers and robo-advisory platform providers

You get a full-scale trading app or a self-directed robo-platform component with configurable guardrails, unified portfolio views, tax surfacing, and advanced robo-trading features. Modular design lets you expand asset classes and regions later.

Traditional banks, neobanks, and super-app providers

You get a comprehensive trading module embedded into your banking app, with unified onboarding, funding rails, SSO, and guardrails for risk. We integrate custody, clearing, and market data, keep latency low, and ensure auditability and compliance.

Why Partner With ScienceSoft for Custom Trading App Development

-

Since 2005 in engineering custom solutions for investment and trading.

- Investment IT and compliance consultants (SEC, GLBA, NYDFS, SOC 2, etc.) with 5–20 years of experience.

- Principal architects with hands-on experience in designing complex trading apps and driving secure implementation of artificial intelligence (AI) and blockchain.

- 60+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Established practices to ensure the high quality of trading apps and their delivery on the agreed timelines and budget despite technical, business, and regulatory constraints.

Types of Trading Applications We Deliver

By platform

- Mobile trading apps (iOS, Android).

- Web trading apps.

- Desktop trading apps (Windows, Linux, macOS).

By target users

- Retail trading apps.

- Institutional trading apps.

- Mixed trading apps.

By asset class

- Stock trading apps.

- Forex trading apps.

- Fund trading apps.

- Derivative (option, futures) trading apps.

- Crypto (including tokenized asset) trading apps.

- Multi-asset trading apps.

By brokerage connectivity

- Single-broker apps tied to one brokerage platform’s infrastructure (examples: Fidelity, E*TRADE, Robinhood).

- Multi-broker apps connected to multiple trading venues (examples: TradingView, MetaTrader, Zerion).

Winning Features for Web and Mobile Trading Apps

At ScienceSoft, we design trading apps around the goals of your business and the expectations of your end users, whether you’re building a lean MVP to test the market or a feature-rich platform to stand out from established competitors.

Below is a comprehensive map of capabilities we can implement. You can choose the essentials you need for launch and add more over time — our consultants will help you identify the right combination for your market and growth plans.

Trader-facing features

App admin features

Secure and Responsive Architecture for Trading Apps

Below, ScienceSoft’s principal architects share a sample architecture we use to create trader applications. As a trading app development company, we have field-tested this concept in commercial and broker-owned apps that offer semi-automated and AI-assisted live trading for retail users.

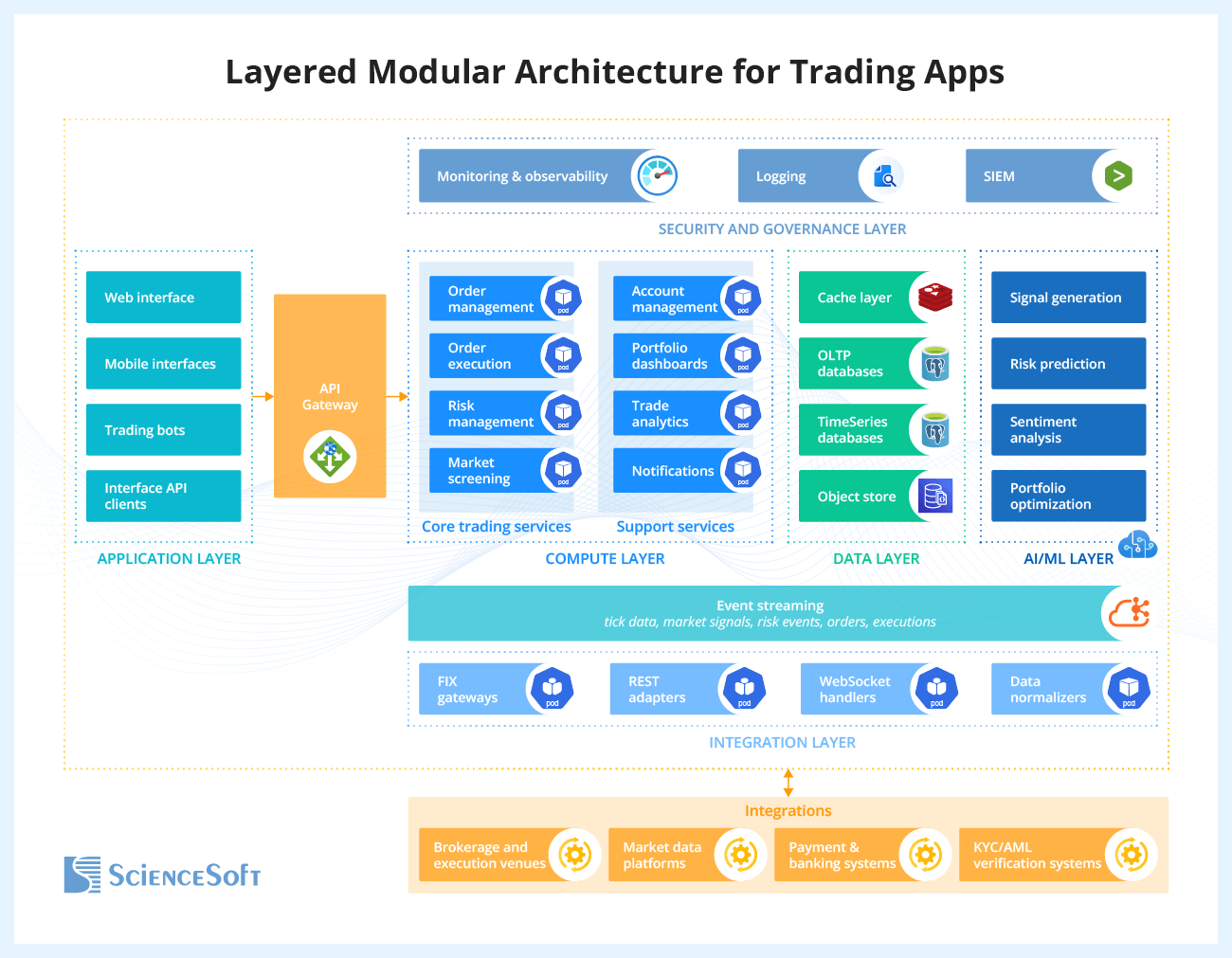

In the proposed cloud-native, layered modular architecture, the trading solution is divided into distinct layers, each responsible for a specific operational aspect. The layers are further broken down into separate components that can be built, deployed, reused, and scaled independently.

Key architectural components and what they serve

Application layer

This layer contains web and mobile user apps for traders. Architects at ScienceSoft recommend enabling programmatic access to let trading bots handle regular trader actions alongside human users. Using interface APIs, your fintech partners can embed trading features from your app in their own apps. Introducing such APIs is a low-cost way for commercial trading app providers to expand distribution channels.

Compute layer

This is the layer that hosts the core logic for trading, trade analytics, and trader account management. Logic modules (portfolio management, ordering, execution, etc.) are packaged as portable Kubernetes containers, each with dedicated deployment and configuration overlays. The single API gateway serves as a central door between the application and compute layers. With this design, back-end teams can focus on developing and maintaining business logic while traders enjoy one stable endpoint regardless of their interface platform.

Data layer

This layer is responsible for data storage and delivery. The storage is organized based on data types and is optimized for efficient data retrieval and cost-effectiveness:

- Real-time, structured data on orders, executions, and positions is stored in the ACID-compliant online transactional processing (OLTP) databases.

- Time-framed tick data and periodic risk snapshots are partitioned, compressed, and stored in the time-series databases.

- Unstructured data like raw market feeds and reports, as well as trading algorithms (including AI models), is stored in the scalable object store.

- The cache layer provides an in-memory datastore that lets you instantly introduce hot market and session data to trader interfaces — a must for live trading.

AI/ML layer

This layer includes intelligent components for real-time market signal generation, risk prediction, sentiment analysis, and trader portfolio optimization. ScienceSoft typically deploys such components as scalable microservices, using third-party AI services by major cloud providers (e.g., AWS’s Amazon SageMaker and Amazon Bedrock, Microsoft Azure’s Azure Machine Learning and Azure OpenAI) to speed up AI model engineering and deployment.

Integration layer

The purpose of this layer is to ensure smooth data exchange between the trading app and trade-relevant third-party systems (brokerage and execution venues, market data platforms, banking systems, and more). The event streaming platform serves as a backbone for delivering external data feeds to every app component in near-real time. Architects at ScienceSoft apply components like FIX gateways, REST adapters, WebSocket handlers, and data normalizers for instant auto-conversion of incoming and outgoing system messages into the chosen normalized formats.

Security and governance layer

This layer provides the monitoring and observability, logging, and SIEM tools to monitor trading app health, detect performance issues and security threats, and maintain compliant operational audit trails for regulatory reviews.

Hide

Benefits of the proposed architecture

|

|

The cloud-native trading app design supports the autoscaling of computing and storage resources as the number of users and trading volume climb. This minimizes risks of capacity-induced app outages and associated financial losses. |

|

|

Modularity allows developers to build, test, and deploy trading app components in parallel, driving quicker delivery. It also enables iterative app growth: you can launch core order flow as an MVP and then bolt on AI modules, new asset classes, and extra regions without re-architecting. |

|

|

Another advantage of the modular design is that you can tailor programming technologies to each module’s specific needs without cross-impact. For example, you can write latency-critical engines in Go, analytics algorithms in Python, and UI APIs in Node.js so that each app component uses the fastest and most productive stack. |

|

|

Segmented data storage allows you to maximize trading data accessibility. It also cuts storage-related expenses, reducing the app’s operating costs. |

|

|

Applying low-latency event streaming platforms (e.g., Apache Kafka, ZeroMQ) and parallel processing pipelines for ticks, trades, and market signals helps achieve sub-millisecond app latency. |

|

|

With the single API gateway, the same endpoint can be reused for web and mobile trading apps, allowing you to introduce omnichannel experiences at a lower cost. |

|

|

The architecture incorporates zero-trust principles, contributing to the stronger protection of the trading app. Its security and governance layer, by design, supports compliance with the SEC’s CAT, MiFID II, and SOC2 requirements. |

The Kubernetes-based compute core of the reference architecture is cloud-agnostic, meaning you can drop it onto Microsoft Azure, AWS, or any other cloud. At the same time, this design pattern allows you to easily replace Kubernetes with cloud alternatives (AWS Lambda or Azure Functions for serverless computing) if they become less expensive or more efficient down the line.

Trading App Development Services Tailored to Your Needs

Trading app consulting

We work closely with your stakeholders to design the core features, architecture, tech stack, and UX/UI for your trading app and make sure they meet the applicable security and compliance requirements. We also help you plan the project, estimate time and cost, and craft risk mitigation strategies. For commercial apps, ScienceSoft’s consultants additionally suggest a winning niche and a unique selling proposition and assist with market entry planning.

End-to-end trading app development

ScienceSoft’s team handles the entire development process, including trading app design, engineering, integration with the required systems, and quality assurance. You obtain an MVP of your trading app in 3–7 months and can introduce it to investors right away; we further iteratively evolve the app with new features (releases every 2–3 weeks). We are also ready to handle post-launch app maintenance and support.

Modernization of legacy financial apps

ScienceSoft can redesign the architecture, UX/UI, and tech stack of your current app, revamp the legacy codebase, and integrate it with new back-office systems and trading venues. In addition, we can turn your financial app into a full-on trading app or upgrade it with innovative trading features to drive its value. Compared to stock trading app development from scratch, you get a modern solution quickly and at a reduced cost.

Challenges of Building a Successful Trading App — And How We Tackle Them

Challenge #1

Any minor flaw in the trading app’s logic can result in asset losses for traders and brokers.

Solution

Challenge #2

Your trading app must meet (or even beat) the market’s tough latency benchmarks to gain a competitive edge.

Solution

Challenge #3

Many vendors build a trading app first and think of compliance later, which may cause costly rework.

Solution

Challenge #4

Many vendors build a trading app first and think of compliance later, which may cause costly rework.

Solution

Traders demand superior UX/UI. Here’s how we design trading apps for smooth user experiences

In trading, every second counts, and any confusion can result in costly mistakes, so if the app’s screens slow traders down or make them think too hard, they’ll leave. At ScienceSoft, we design trading apps with clarity and speed in mind. Our goal is to reduce clicks, avoid clutter, and make trading feel effortless.

Our UX/UI design process starts with task-focused user journey mapping. We break down each trading interaction into its core decision points and actions and translate these flows into wireframes and interactive prototypes. By testing them early with representative users, we can quickly uncover usability issues. We also enable interface customization to let traders tailor their private spaces to specific needs and skill levels.

When it comes to UX/UI components, we apply intuitive data hierarchies, minimalist layouts, and predictable interaction patterns for frequent trader actions (e.g., tap-to-trade, swipe-to-analyze). This ensures each screen supports rapid decision-making. Contextual tooltips and confirmations further simplify trader journeys and reduce the risk of error.

Our Tech Stack for Web and Mobile Trading App Development

In investment platform development projects, ScienceSoft usually relies on the following technologies and tools:

AI

Machine learning platforms and services

Machine learning frameworks and libraries

DevOps

Containerization

Automation

CI/CD tools

Monitoring

Blockchain

Smart contract programming languages

Frameworks and networks

Cloud services